India is one of the fastest-growing economies in the world, with a rapidly expanding middle class that is increasingly tech-savvy. As more and more people get connected to the internet, they are discovering the convenience and ease of using mobile apps for managing their finances. One area that has seen a particularly rapid rise in popularity is online bill payment apps.

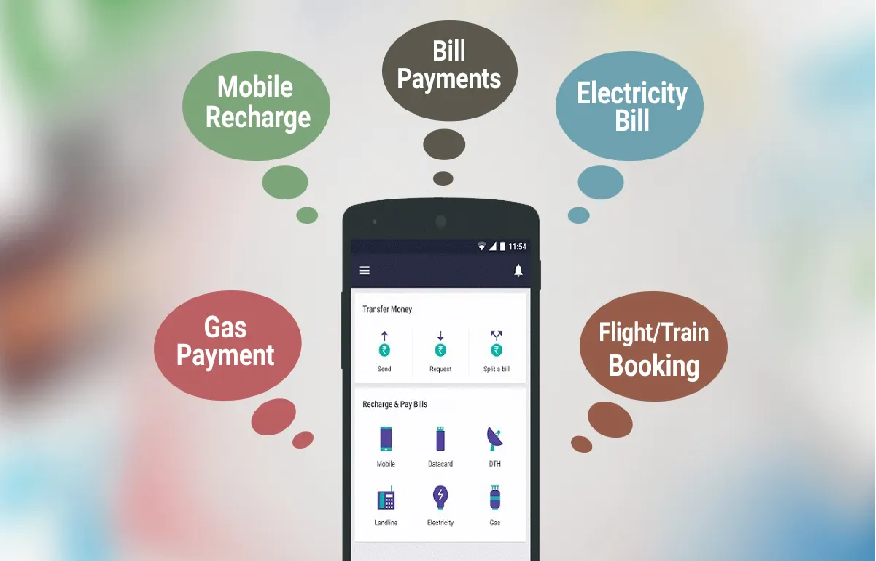

Online bill payment apps offer a simple and convenient way to pay bills using a smartphone or tablet. These apps allow users to manage their bills on-the-go, without having to worry about forgetting to pay a bill or missing a due date. They also offer a range of features that make it easy to manage multiple bills at once, including reminders, alerts, and automatic payments.

For many people in India, online bill payment apps have become an essential part of their daily lives. In this article, we will explore the demographics, adoption rates, and trends driving the rise of these apps, and look at how they are changing the way people manage their finances.

Demographics of Online Bill Payment App Users in India

The demographic profile of online bill payment app users in India is diverse, reflecting the country’s enormous population and disparate economic backgrounds.

One significant factor driving the growth of online bill payment apps in India is the rise of the country’s middle class. A growing number of people in India now have access to smartphones and the internet, and this is fueling demand for online banking and finance apps.

According to a recent report by the India Brand Equity Foundation (IBEF), the middle class in India is expected to double in size to 540 million people by 2025. This growing middle class, with its increasing purchasing power, is driving demand for a range of products and services, including online bill payment apps.

In addition to middle-class consumers, online bill payment apps in India are also being used by younger consumers who are more tech-savvy. According to a report by the Boston Consulting Group (BCG), two-thirds of Indian internet users are under the age of 35, and this group is more likely to use mobile apps for managing their finances.

Adoption Rates of Online Bill Payment Apps in India

The adoption rates of bill payment on mobile in India have been rapidly increasing over the past few years, fueled by the growing number of smartphone users and the increasing availability of high-speed internet.

According to a report by the Reserve Bank of India (RBI), the number of digital transactions in India increased by 55% in 2019-20, with online bill payment apps accounting for a significant portion of this growth. The report also found that the share of digital transactions in India’s overall payments increased from 42% to 82%.

The rise of online bill payment apps in India has been especially pronounced in urban areas, where the infrastructure for digital payments is more developed. According to a report by the consultancy firm Deloitte, mobile payment transactions in India are expected to grow 3.7 times to $1.8 trillion by 2023, with much of this growth coming from urban areas.

Trends Driving the Rise of Online Bill Payment Apps in India

There are several trends driving the rise of online bill payment apps in India, including the increasing availability of high-speed internet, the growing middle class, and the increasing number of people who own smartphones.

One trend that is particularly significant is the increasing use of mobile wallets and apps for making payments. According to a report by the consultancy firm Accenture, the number of mobile wallet users in India is expected to grow fourfold by 2027. This growth is being driven by the rise of digital payments, which are now being accepted by a wider range of retailers and service providers.

Another trend driving the rise of online bill payment apps in India is the increasing availability of financial services online. With more and more financial institutions offering their services online, it is becoming easier for people to manage their finances digitally, without having to visit a bank or financial institution in person.

If you are looking for a reliable and convenient way to manage your bills, the Bajaj Finserv App is the perfect solution. This app offers a range of features that make it easy to manage your bills on-the-go, including automatic payments, reminders, and alerts.

With the Bajaj Finserv App, you can pay your bills quickly and securely, using your smartphone or tablet. The app is easy to use, with a simple user interface that makes it easy to manage multiple bills at once.

Whether you are looking for a way to pay your electricity bill, your mobile bill, or your credit card bill, the Bajaj Finserv App has you covered. With a wide range of billers supported, you can easily manage all your bill payments in one place, without having to remember multiple login credentials.

The App also offers investment options like mutual funds, fixed deposits, SDP. You can open your demat & trading account and start trading. Bajaj Finserv App also provide insurance, different kinds of loan to suit all your different financial needs with flexible repayment tenor and affordable interest rates. You can apply online on the app, shop for electronics, furniture, apparels and more from top brands online, book your bus, flight, train tickets and also order delicious food online at amazing offers on the Bajaj Finserv App. You can avail exclusive Bajaj Coins and other rewards on your daily transactions and utility bill payments, making it a rewarding experience.

In conclusion, the rise of online bill payment apps in India is driven by a combination of factors, including the growing middle class, the increasing availability of high-speed internet, and the growing number of people who own smartphones. With the Bajaj Finserv App, you can stay on top of your bills and manage your finances on-the-go, without having to worry about missing a payment or forgetting a due date.